Distributed Wind Energy 101

Distributed and Community Wind Energy

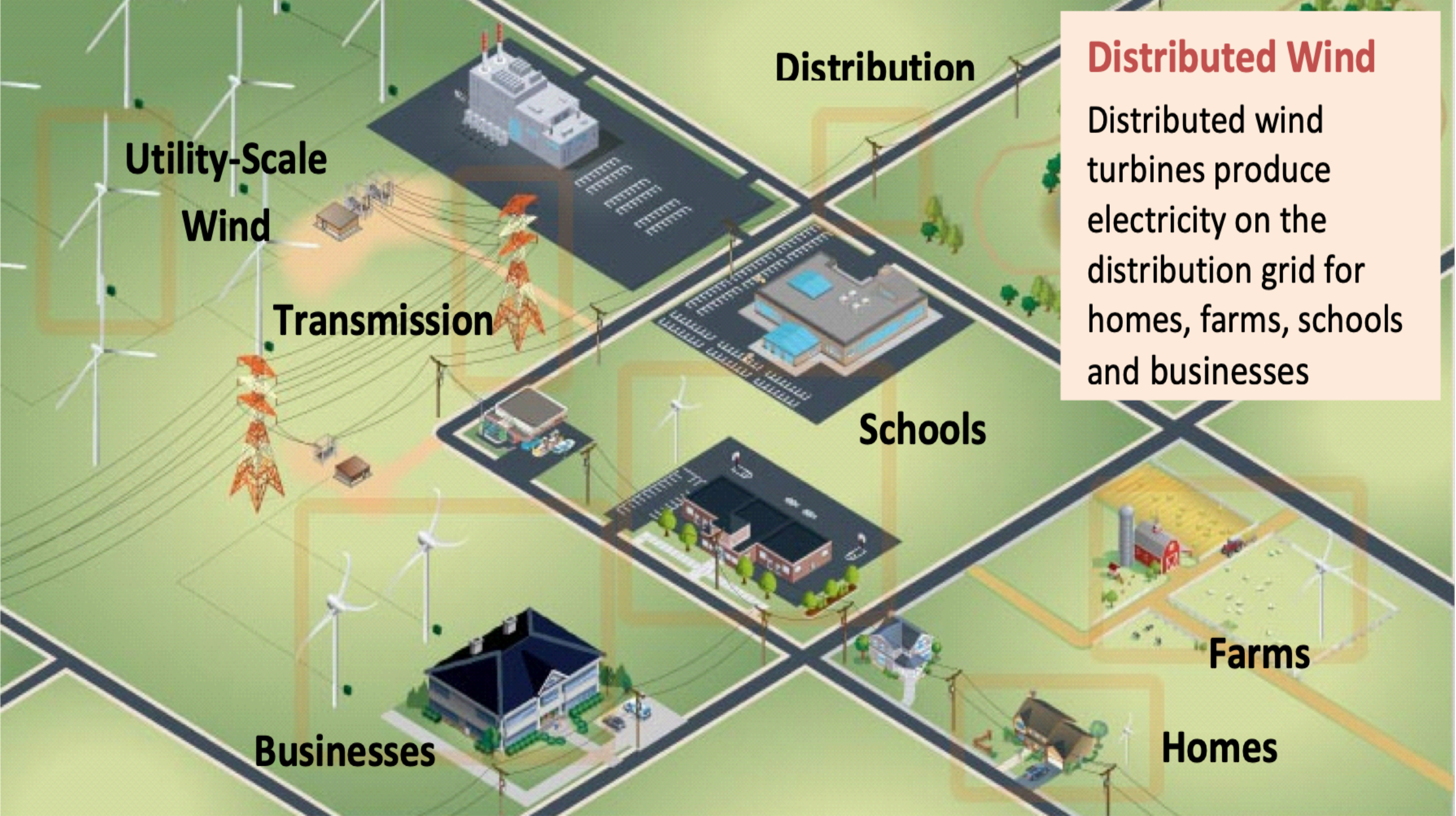

❖ Distributed Wind: is the use of one or a few wind turbines at homes, farms, businesses, and public facilities to off-set on-site energy consumption or small arrays placed close to loads (front-of-meter)

❖ Community Wind: medium – large wind turbines with significant local participation (like Community Solar)

Homes Distributed wind turbines on the distribution grid. Source: U.S. Dept. of Energy

Benefits of Distributed Wind Energy

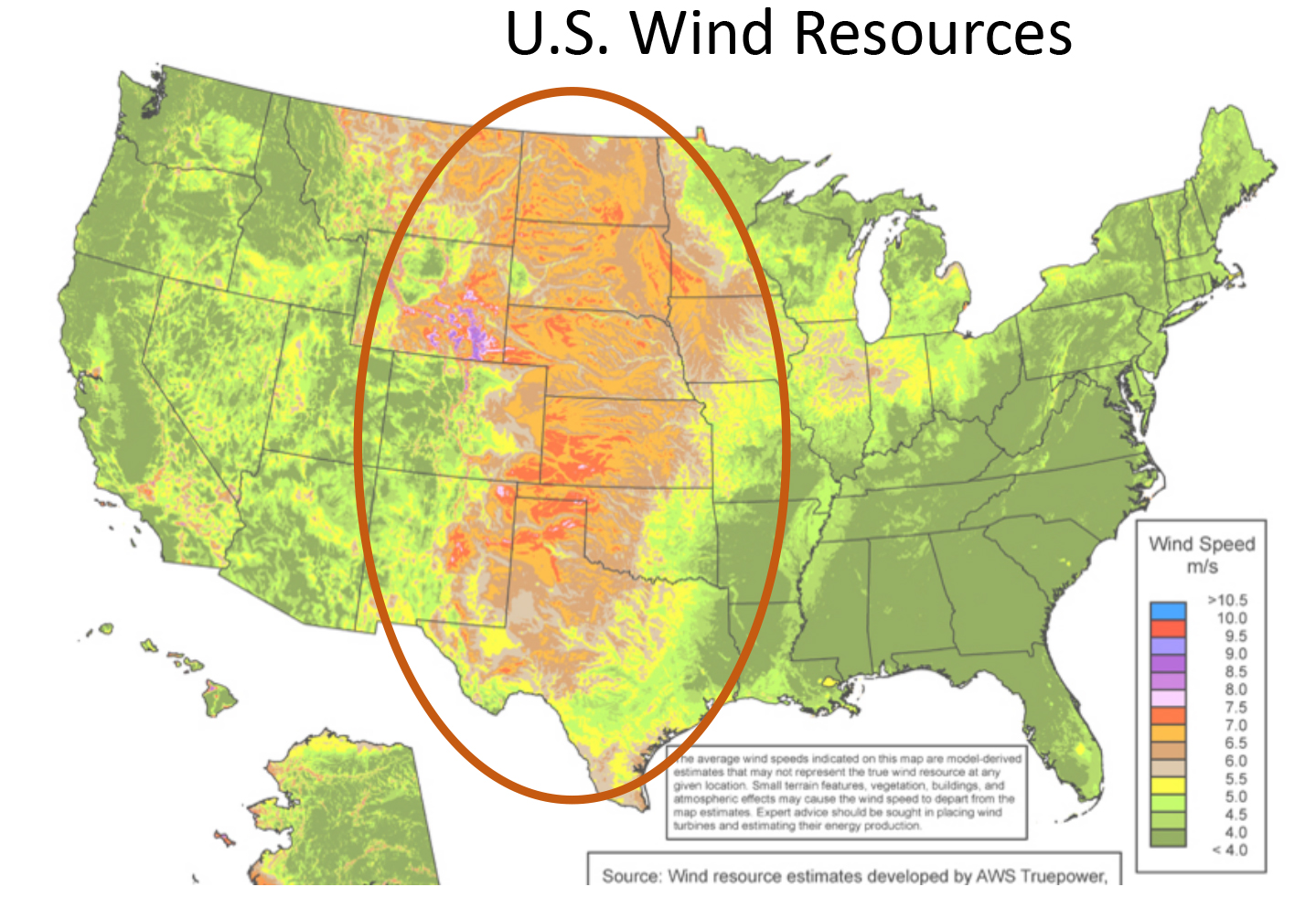

❖ Least-cost renewable technology in areas with good wind resources

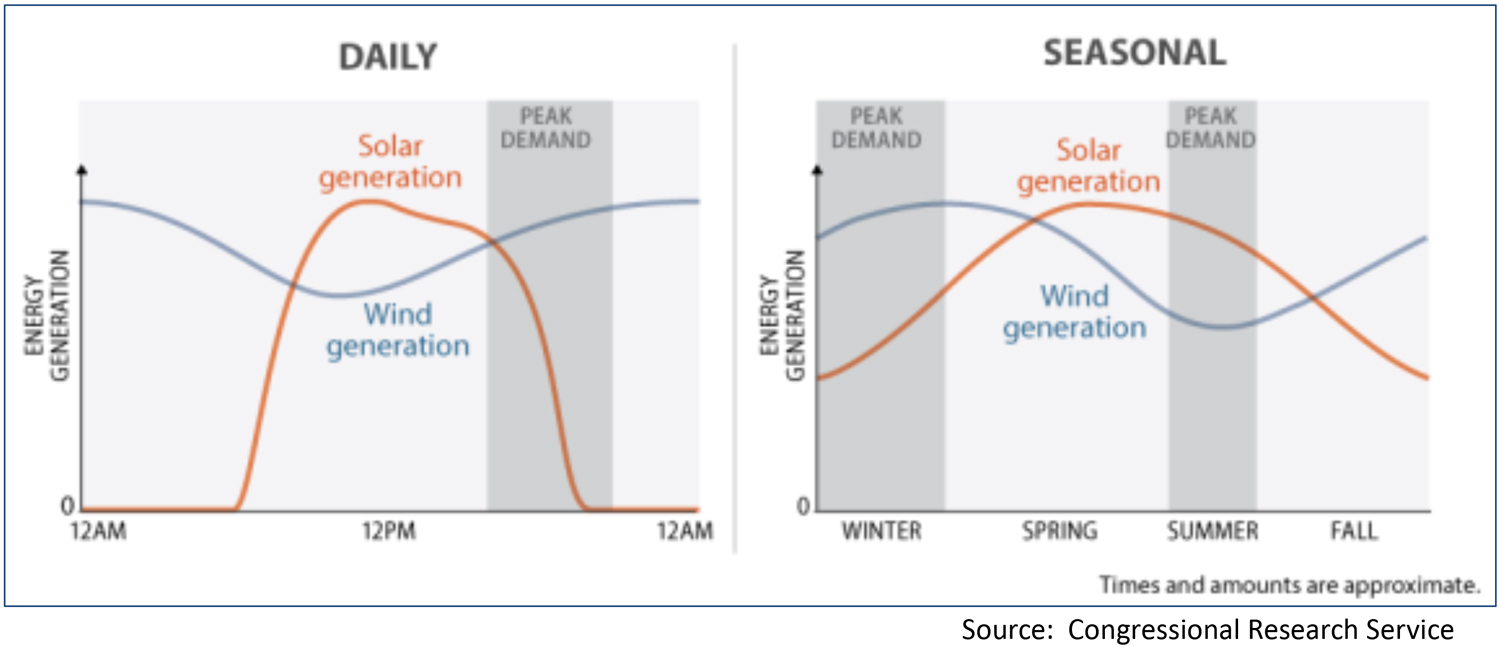

❖ Leverages America’s technology and manufacturing strengths Complements solar; reduces need for storage and back-up Small footprint compared to solar Strengthens the grid and promotes resilience Ramps faster than some other clean energy technologies Provides branding for environmental stewardship

More Expensive, but also More Valuable

Windfarm Turbines

❖ ~ $1,500 / kW

❖ Providing Wholesale

Power, sold at: 2 – 4¢/kWh

Distributed Turbines

❖ ~ $3-9,000 / kW

❖ Providing Retail

Power, sold at: 8 – 42¢/kWh

Wind and Solar are Complementary Energy Sources

Distributed Wind, with Less Automation, is a “Jobs Machine”

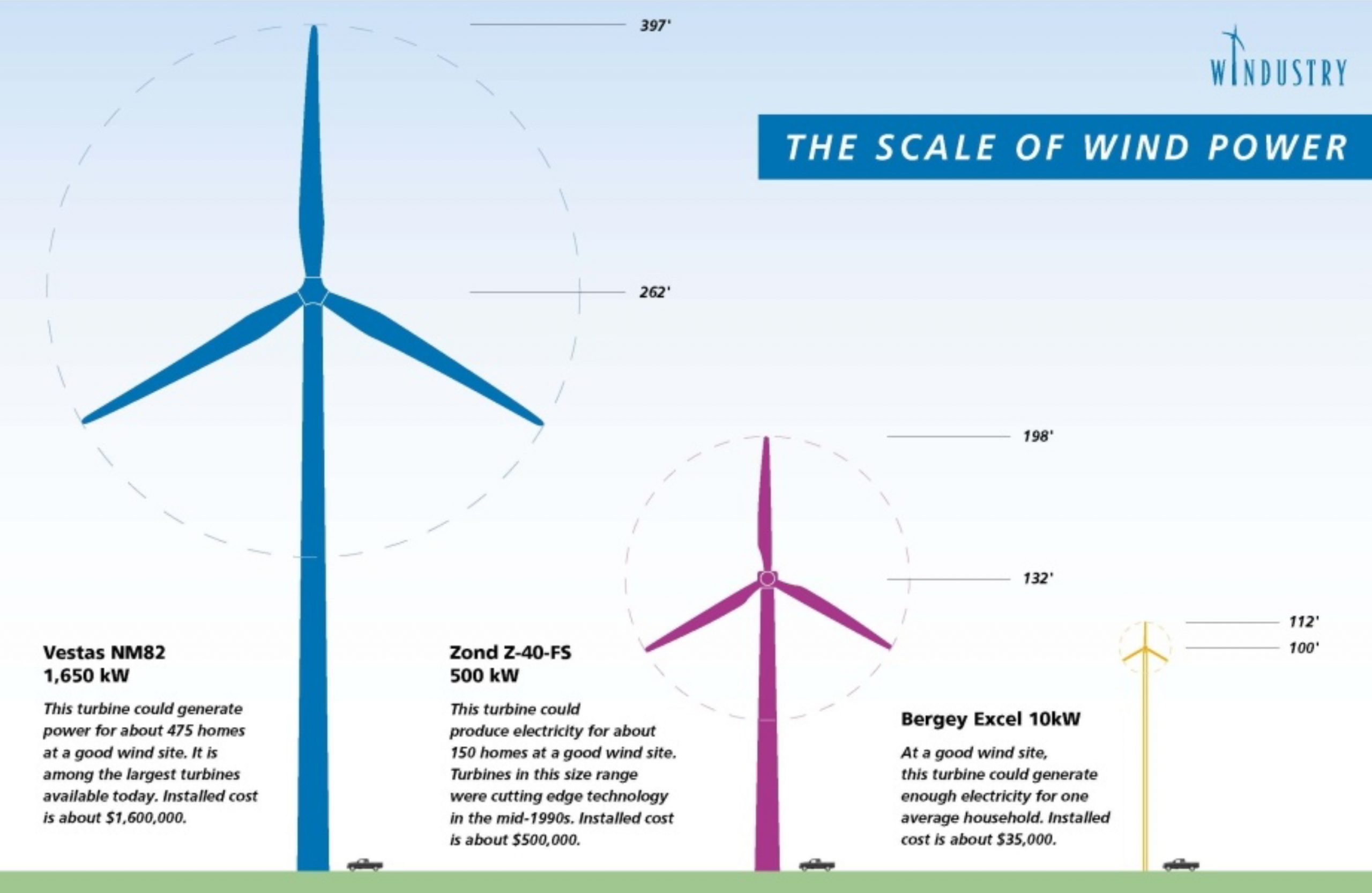

Turbine Size Classifications

❖ Small: 0 – 100 kW

❖ Manufacturers: Primo, Sonsight, Ryse, SD

Wind, Bergey, QED, Xflow, Eocycle, Pecos,

Northern Power

❖ Mid-Size: 101 – 1,000 kW

❖ Manufacturers: Siva, Carter, EWT

❖ Large: > 1,000 kW (> 1MW)

❖ Manufacturers: GE, Goldwind, Vestas,

Siemens

FTS Enterprises Juniata, NE

Install by:

– 15 kW turbine on 100’ tower

– Installed June 2021

– Produces ~ 50,000 kWh per year

– $100,000 installed; USDA grant + Tax Credit + Bonus Depreciation = 2 year payback

Heritage Dairy Farm Yuma, CO

Install by:

– 2 x 100 kW turbines on 100’ towers

– Installed October 2016

– Turbines produce 480,000 kWh/yr – 60% of dairies’ annual energy

– Utility: Y-W Electric Association (REC)

Anhueser-Busch Brewery Fairfield, CA

Install by:

– 1,850 kW turbine, “Bud Light”, on 260’ tower installed August 2014

– Brewery’s second turbine: 1,500 kW turbine installed in 2011

– Two turbines provide 30% of energy demand (equal to 33,000 cases of beer per day)

– Installed under Power Purchase Agreement (PPA)

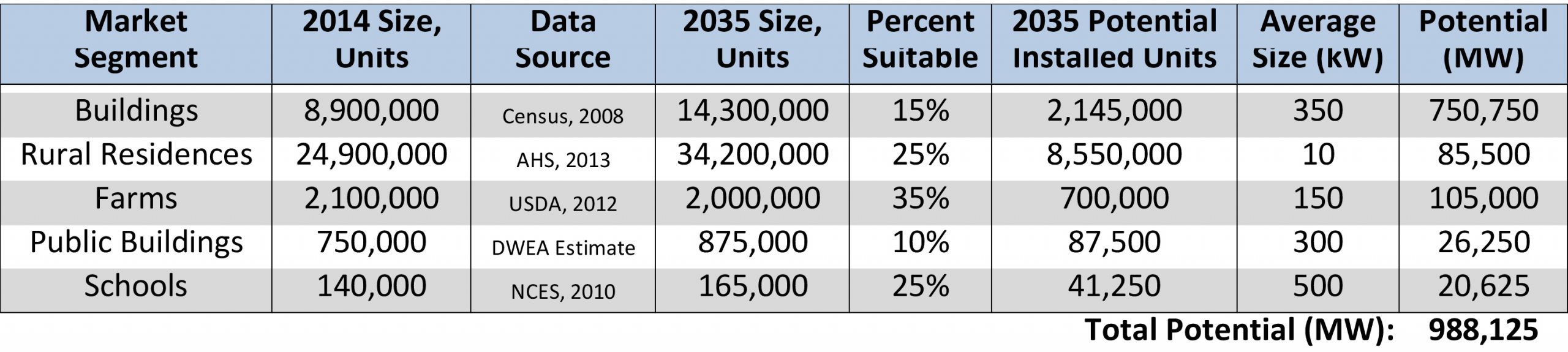

DW Potential: Comparable and Complementary to Offshore Wind

2016 & 2022 NREL Reports:

• Technical feasibility: 49.5 million residential, commercial, industrial and public sites

• Economic feasibility in 2022: 1,400 GW

• Economic feasibility in 2035: 6,000 GW

Offshore Wind serves larger coastal communities. Distributed Wind serves smaller interior, transitional and more disadvantaged communities. Both have large supply chain opportunities, but DW is far less developed.

2035 DW Potential: 1,000 GW

DWEA 2035 DW Goal: 35 GW

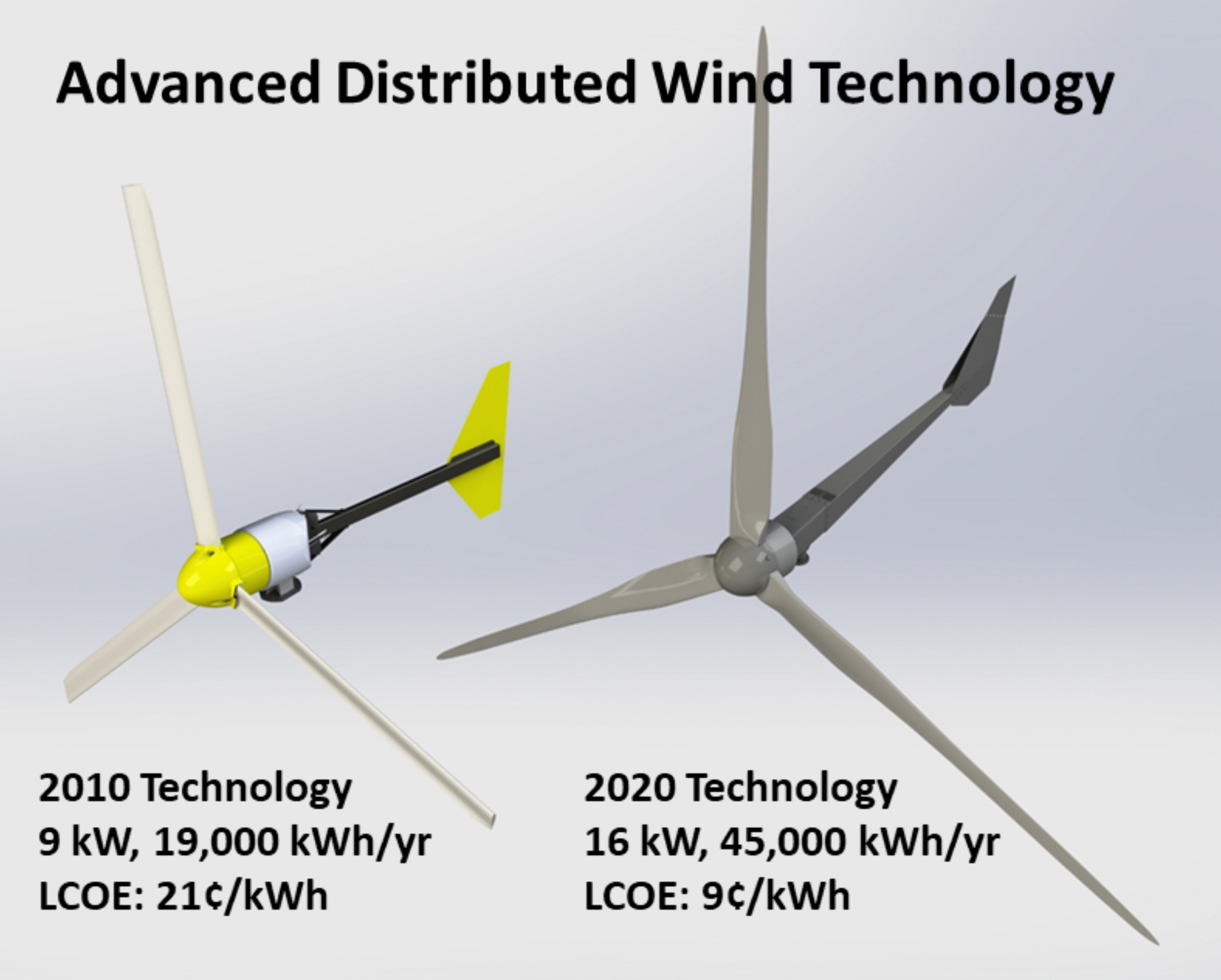

Major Cost Reduction Potential

LCOE: Levelized Cost of Energy – Source: DWEA Vision Report, 2016

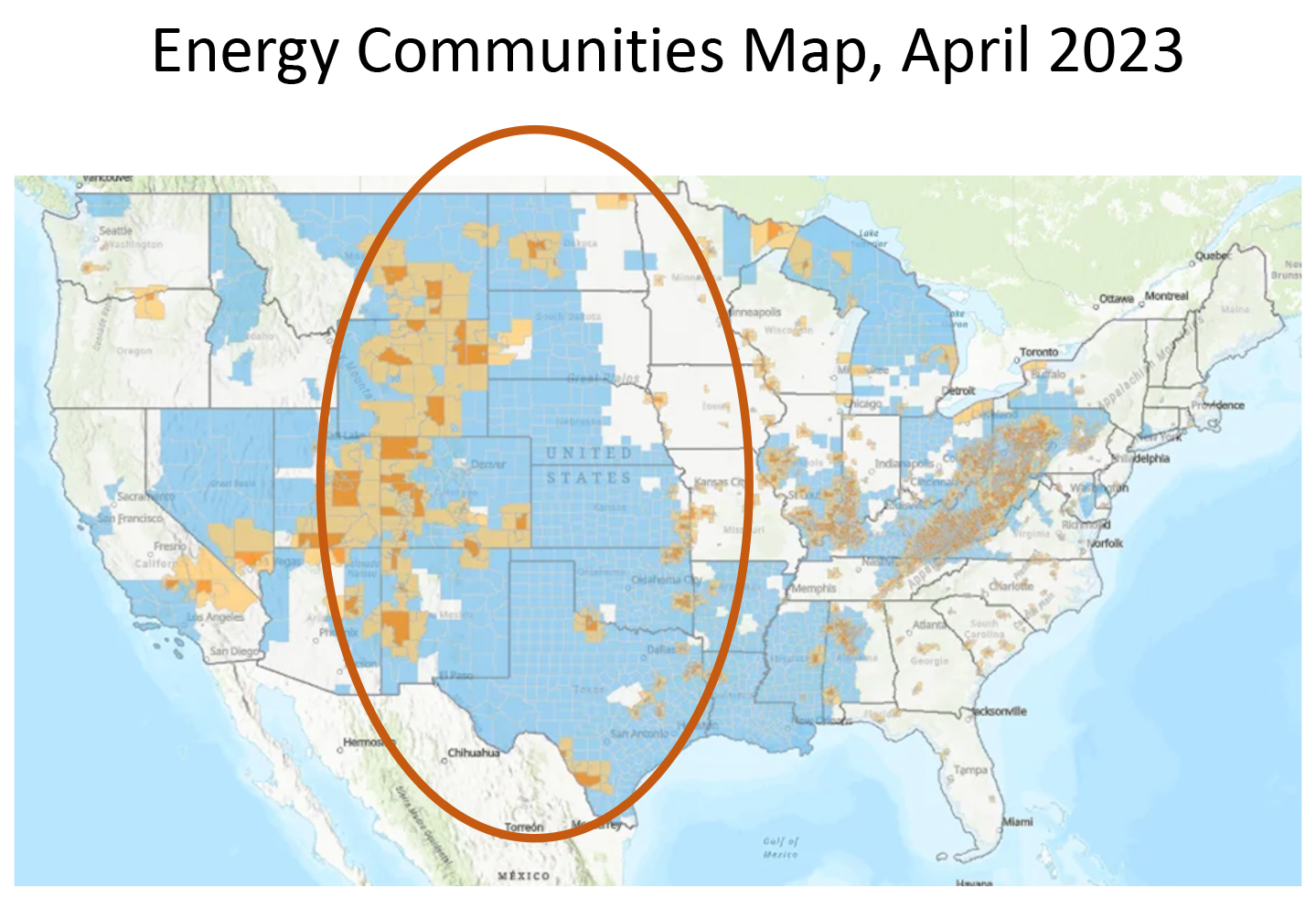

Inflation Reduction Act of 2022: Transformational for the DW Industry

IRA Policies Supporting Distributed Wind

• 30% Investment Tax Credits for Residences (through 2032)

• 30% Investment Tax Credits for Businesses & Non-Profits (lower requirements for projects under 1 MW) through 2032

– 10% Bonus for Domestic Content

– 10% Bonus for being in an Energy Community zone (mapped annually)

– 10-20% Bonus awards for projects in low income zones

– Transferability for For-Profits

– Elective Pay (rebate) for Non-Profits

• 1 (Sec. 179) or 5-Year depreciation for businesses

• Manufacturing Tax Credits for Domestic Production, with limited Direct Pay

• USDA REAP Grants up to 50% for Ag Sector and Rural Small Businesses – “Underutilized Technologies” set-aside for wind projects Policies for Distributed Wind Growth

• Preserve USDA REAP funding and the Underutilized Technologies sub-program

• Investment Tax Credits: §25D (residential) parity with §48 (business)

• Appropriations: Increase the US-DOE DW funding from $13M to $30M

• DOE should highlight DW with a major new DW deployment initiative

• Add distributed wind to incentive programs provided for solar